What Happened to Terra and Why We Got Out

What does the UST stablecoin situation mean for the future of ALL stablecoins (and non-algorithmic ones) and the crypto ecosystem?

The most important thing to remember is that not all stablecoins are created equal. In its simplest form, a stablecoin is a claim on dollars sitting in a bank account (a “scrip” for those who enjoyed Finance 101). Now, assuming the dollars are in the bank and accessible, then the value of that claim is secure. If, however, there are fewer assets than claims on the account, then the stablecoin is fractional or under collateralized.

With that framework, we can rank all stablecoins according to how well collateralized they are. On the one end, you have USDC, which is almost entirely backed by dollars or short term treasuries and you can always redeem the stablecoin (ie give back the scrip and get dollars in exchange). Unless those dynamics change, USDC’s peg should stay solid.

UST is/was on the other end of the spectrum. The “collateral” was originally entirely their LUNA token (they added small amount of non LUNA assets late in the game). The trouble is that LUNA itself has no intrinsic value and so, it was inevitable the peg would break. That’s why we at Diffuse spend so much time monitoring stablecoin collateral levels.

The rise and fall of algorithmic stablecoins like UST, IRON, and arguably FRAX is a story of greed. Investors can’t see past the crazy high yields and the the issuers can’t see past the piles of money they were making as the adoption of their stablecoin grows.

That’s human nature.

The solution, which our species has learned over and over again, is regulation.

On of our board member loves to say, “Nothing changes until something bad happens.” We hope the UST peg break is the impetus for the drafting of intelligent stablecoin regulation and/or a US Central Bank Digital Current (CBDC) that is fully backed by USD.

Can there be trust restored from people to continue using stablecoins, if so how?

A regulatory framework would help restore people’s trust. Even if stablecoins issuers have to opt in to being scrutinized by the government (audit their assets, etc) it would give allocators the ability to distinguish between scam tokens like Terra and well-maintained ones that are happy to have someone keep them honest. This would act as a seal of approval.

Barring that, one of the cornerstones of digital assets is transparency. Consumers and allocators should demand the same when it comes to collateral. What exactly are you holding? Cash like USDC? Chinese commercial real estate debt like USDT? An empty sack like UST? Do you homework and don’t let greed steer you wrong.

What is needed to move forward from this situation?

There are plenty of good stablecoins out there and as Buffet has said, “Only when the tides goes out do you discover who’s been swimming naked.” The current market sell off is exposing a lot of butt cheeks.

This creates opportunity for folks like Diffuse who strive to think hard about the risk and deliberately manage our exposure. So many people have been burned by this event that we’re excited about the investing opportunities that we’ll have for the remainder of the year! Now’s the time to get in the water.

What options do investors have?

Innovation in digital assets moves so fast that it is impossible for any one person to stay abreast of everything… even if they’re doing it full time. Folks with a day job who dabble in the evenings are bound to have a bad outcome. Considering using a professional money manager like Diffuse who have teams of folks whose entire job is to live and breathe crypto.

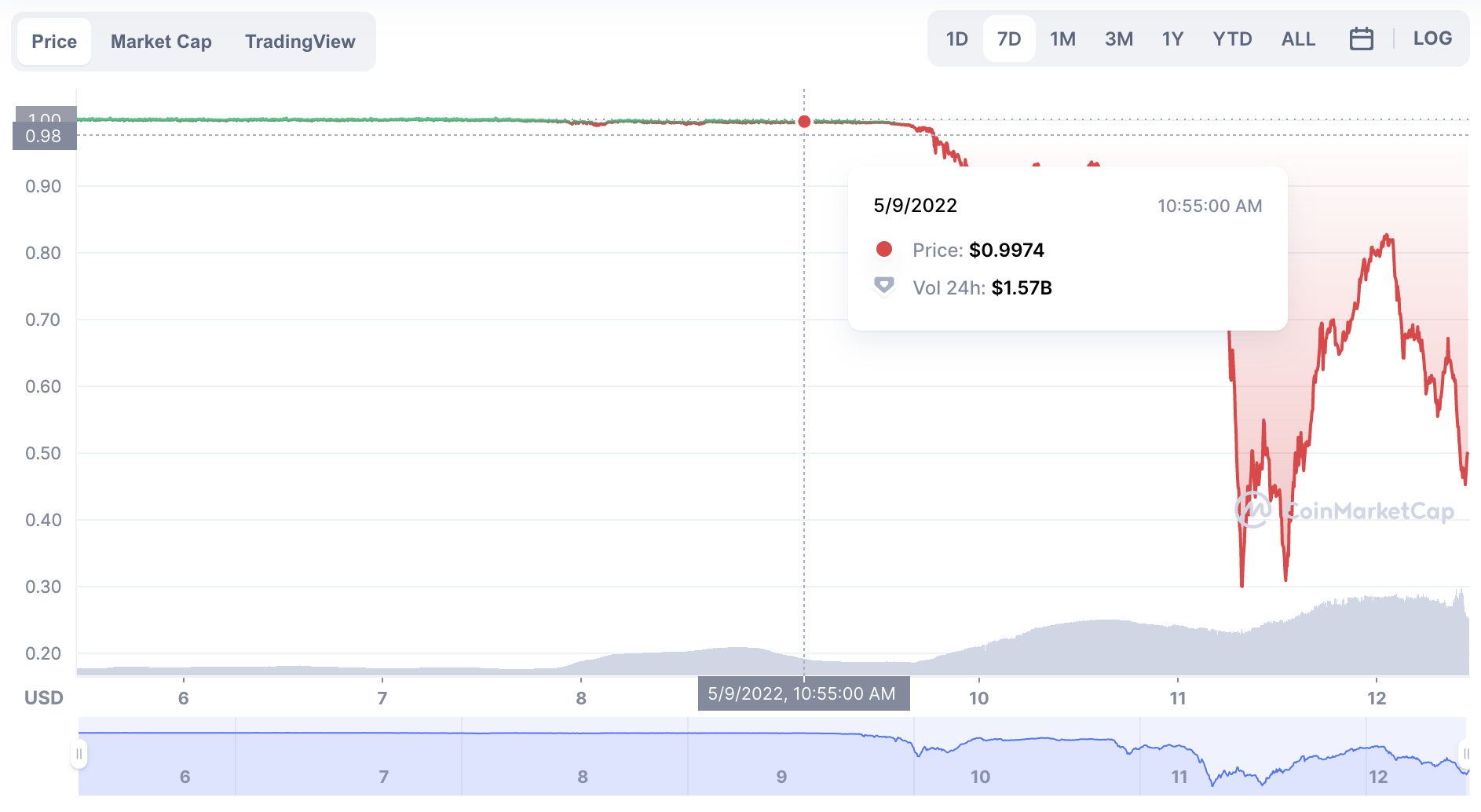

Sidenote: See where we got out for our StableFi fund in the screenshots below … Our streak of only profitable months since inception remains intact.