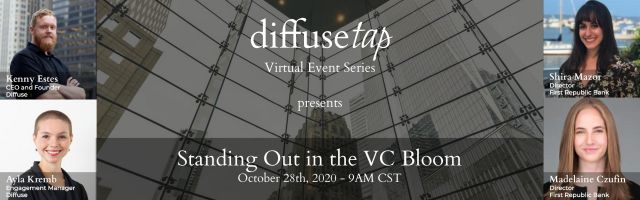

Standing Out in the VC Bloom

In response to the ever-increasing demand for early stage capital, there has been a spike in the number of Micro-VCs (with $25-$100MM in AUM) and Emerging Managers who’ve raised fewer than three funds. This increase of active Emerging Managers can make it difficult for them to know how to stand out and get LPs on board with their team story, investment thesis, and overall fund strategy.

If you’re an Emerging Manager raising your fund, how do you make sure you don’t get overlooked?

In our recent DiffuseTap session, we had the chance to talk with two Directors at First Republic Bank, Shira Mazor and Madelaine Czufin, who focus on banking in the VC and startup ecosystem and work with all stages of fund managers and their portfolio companies. Shira and Madelaine talked about the growing competition for active fund managers raising capital and how they are supporting these new managers.

DiffuseTap is a weekly virtual event hosted by Diffuse that is part networking (you’ll meet at least a half dozen high caliber startup players) and part purposeful (you’ll DiffuseTap new ideas). If you want to make new friends and connect with experienced professionals from our VC ecosystem, email us at contact@diffuse.vc.

Setting Yourself Apart

Many Emerging Managers want to make sure their stories stand out to LPs, but they don’t always know what the prospective LP is really looking for. According to Shira, a key factor for LPs is the track record of the founding General Partners.

“I know that sounds impossible: how can you have a track record if you’re an Emerging Manager? But LPs really look for that, either if it’s in the form of an SPV track record or something that comes from experience as a direct investor. Also, it’s important to highlight each GPs areas of expertise and how they relate that to their investment thesis and the companies they will support. Often you may be asked ‘What career have you built for yourself? Are you an expert in the specific industry and are you well-networked in it? Can you defend your thesis?’ Initially, those are the things that make Emerging Managers stand out.”

Because Emerging Managers by definition are only starting their initial funds, most don’t have a large track record of exits to account for. Rather, GPs can highlight other progress of their other investments, such as follow-on rounds or new investors on the cap table, which are all good points of reference, especially earlier on in the fund lifecycle.

Importance of Diversity

A good track record is one way to stand out, but there are other factors worth considering. Madelaine stressed that, now more than ever, LPs are looking at different metrics around diversity as a key area in the diligence process.

“LPs are increasingly becoming more proactive in looking at diversity metrics in their diligence process. It is important for the fund’s leading team to reflect a value in diversity, encompassing diversity of thought and lived experience along with different areas of expertise. This makes a lot of sense given the data shows that more diverse teams, from junior to executive levels, produce better results and are more sustainable long term.”

Your Time is Your Value

As an early fund manager, it is also important to balance your allocation of time. Shira highlighted the importance of utilizing your different service providers, in order to ensure that you are getting the full support you need as you grow and scale your firm.

“It is important to have the right person, whether it is your bank, law firm, fund admin, etc. who can support you. You should leverage those connections and opportunities as much as possible.”

In closing, Madelaine emphasized that a key attribute of their team is the hands-on approach they take.

“We support you beyond just banking by offering other services helping you expand your networks, providing access to tools for your portfolio, giving you support as you go through the fundraise process, and share other products so you can do what you do best: make great investments in companies for strong returns for your LPs!”

Meet the Speakers

Shira Mazor and Madelaine Czufin are Directors at First Republic Bank. They support their clients through all stages of growth for their fund or business. With more than 60 offices on the West Coast and in the Northeast, First Republic Bank offers a complete range of lending, deposit, investment, trust, and brokerage services. To learn more, feel free to email at smazor@firstrepublic.com and mczufin@firstrepublic.com.

Find an event near you